The question is not really how much life insurance you need, it is how much money your family will need after you are gone.

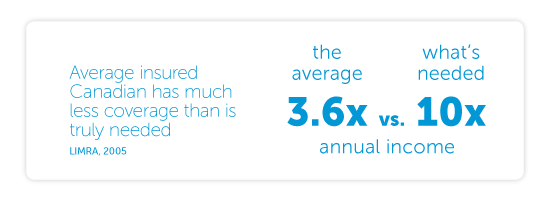

Did you know? Three in four Canadian households with children under 18 are underinsured (LIMRA Study, 213)

Everyone’s financial circumstances and priorities are different but here are some questions to help you focus:

- How much money will your family need to meet immediate expenses such as funeral expenses, legal fees and outstanding debts and mortgage balances?

- How much money will your family need to maintain their standard of living over perhaps several years? This could include everyday living expenses, money for a child’s post secondary education, or your spouse’s retirement.

The key to determining how much life insurance you require is really taking some time to do some research. Here are some steps to help with this evaluation:

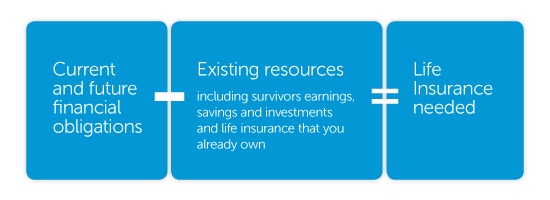

- Gather all of your personal financial information and estimate what each of your family members would need to meet current and future obligations. This would include items such as funeral expenses, mortgage payments, car loans, credit card debt, education expenses, and replacement of your income.

- Tally up all of the resources that your family members could rely on to support themselves in the event that you pass away. Are there any savings or another income to rely on?

- Determine what the difference is between point #1 (obligations) and point # 2 (resources).

This research will be the starting point for determining how much life insurance you actually need. After that, it is time to get further guidance and assistance from a qualified financial advisor. They will be able to tweak your research even further to reflect your personal circumstances, and from there come up with a customized financial plan to provide the necessary security for you and your family.

The DreamWorks animation movie Shark Tale starts with a young fish, Oscar, showing the viewer around his penthouse apartment, which when the camera pans out, we quickly realize he’s simply pretending in front of a large billboard advertisement. Unaware of the illusion, Crazy Joe the hermit crab, calls out to Oscar – “now that you live in a penthouse, can I be your financial advisor?”

The scene depicts what many people believe – you only need a financial advisor when you have money.

There is no question that having a financial advisor if you’ve come into a large inheritance or if you’ve had a sudden increase in income would be a good choice. But what about if you are having a baby, recently divorced, or simply feel uneasy about your current financial situation?

Whatever your money questions are, a financial advisor can help you get organized.

Just like every other choice that life presents to us – choosing a partner or spouse, a job, or a place to live – selecting your financial advisor needs be carefully considered. You need to be totally comfortable disclosing financial information and future goals and aspirations to your advisor, and trust the recommendations your advisor makes.

So how do you find the right match with a financial advisor?

1) Investigate your options. Get recommendations from family members, friends, co-workers or other professional networks. Be specific about what you are looking for.

2) Consider credentials. You don’t necessarily need the alphabet soup after the advisor’s name but search for financial planners who have designations and credentials that require extensive education in financial planning. Look for advisors with a Certified Financial Planner (CFP) designation or who have completed the Life License Qualification Program (LLQP).

3) Conduct interviews of two or three financial advisors before making a selection. While credentials and experience are very important, you also want to work with someone you like, trust, and can understand.

4) Check references. Ask for names of clients who have worked with the planner for long periods. Don’t ask them only the expected questions about the planner’s positive attributes, but also about his or her greatest weaknesses.

5) Consider how the advisor is paid. Most financial planners are paid either through commission from the companies whose products they sell, or as a percentage of market value of the money that they are managing for you.

In the end, choosing a financial advisor comes down to trust. You will be providing your financial advisor with a lot of details regarding your financial life and you need to feel like they have listened to you and that there are no unanswered questions when it comes to your money.

Make the right match and avoid the brutal honesty experienced in Shark Tale –

Oscar: I’m not really a shark slayer… I lied.

Crazy Joe: [remorseful] And, I’m not a financial advisor!

Talking to an advisor?

Here are some questions to ask:

- How long has the advisor been in business?

- What company or companies does he/she represent?

- Does the advisor belong to a professional association?

- Has the advisor qualified for professional accreditations?

- Is the advisor licensed in your province?

- Will the advisor provide references from other clients?

Life insurance is one of those things—you don’t want to learn how important it is once it’s too late. But that doesn’t mean we know all the right things to do when it comes to getting a life insurance policy.

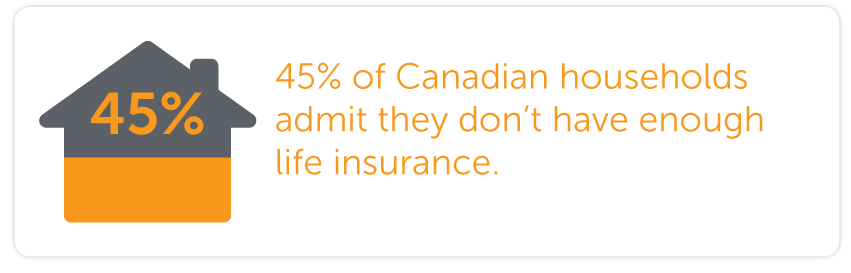

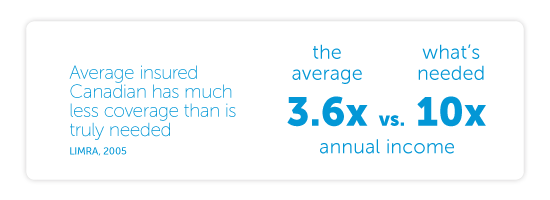

Did you know that according to a nationwide survey conducted by LIMRA, fewer Canadians have life insurance than in the recent past (43%) and 45% of Canadian households admit that they don’t have enough life insurance.

One of the reasons that many state for not purchasing life insurance is that it is too expensive. Did you know that for about the cost of a daily cup of coffee that a thirty-something can purchase a life insurance policy that covers the amount of the average mortgage on a new home in Canada*? So, what does it take to make life insurance a priority?

We invite you to share your story of “inspirational insurance” – a real life story of how life insurance can – or did – make a difference in your life or in the life of someone you know.

*Based on available rates for a 40-year-old female, non-smoker, purchasing $250,000 of 20-year term insurance as of October 2013.

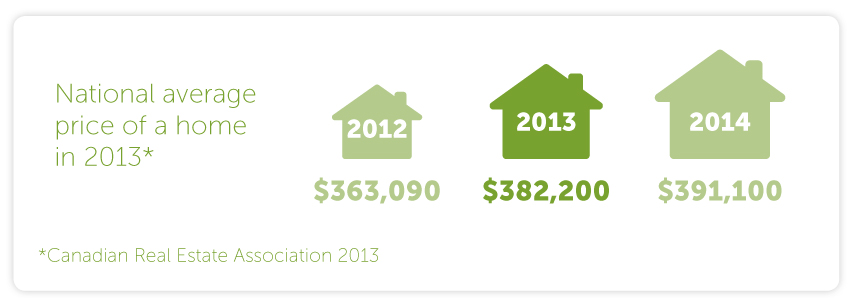

Buying a home can be the single biggest purchase an individual will ever make.

According to statistics released this year by The Canadian Real Estate Association (CREA), national home sales declined for the third consecutive month in December 2013. However, the CREA indicates that 475,000 homes were sold nationally, a 4% increase from 2012.

For most buyers, that purchase involves a substantial mortgage and years of debt.

It is important for homeowners to know that there are options when it comes to protecting their mortgage and their family’s finances from the unexpected.

Homeowners have the option of purchasing mortgage insurance from mortgage lenders or through an individual insurance policy offered by an insurance company.

When comparing various features, homeowners can benefit from purchasing a life insurance policy instead of mortgage insurance from a mortgage lender.

Here are some of the primary advantages of term insurance:

- No need to re-apply for coverage if you move or need to re-financeWith lender mortgage insurance, if the homeowner switches banks, moves, or sells their home, they will have to take out another policy. This could be a challenge if there have been any health changes.

- You choose your beneficiaries and they decide how the money is usedWith lender mortgage insurance, if the homeowner passes away, the lender will simply pay off the mortgage balance. In contrast, under an individual life insurance policy, the homeowner can choose one or multiple beneficiaries and they can use the money for other debts and living expenses as well.

- With term life insurance your coverage remains the same, even as your mortgage decreasesWith lender mortgage insurance, the coverage declines as the insured’s mortgage declines. This means the insured gets less and less value for the premiums that they are paying. For example, if a $300,000 mortgage insurance policy starts at $50 a month, it may seem like a good deal. But as the mortgage reduces to $150,000 and the premiums remain at $50 a month, the policy offers significantly less value.

- Buying mortgage insurance from the bank may be convenient, but it could cost moreIn general, the rates for lender mortgage insurance are typically higher than those policies sold by insurance companies for term life insurance.

Consumers are always looking for ways to save money and it’s no different when it comes to purchasing life insurance.

Here are six tips to save:

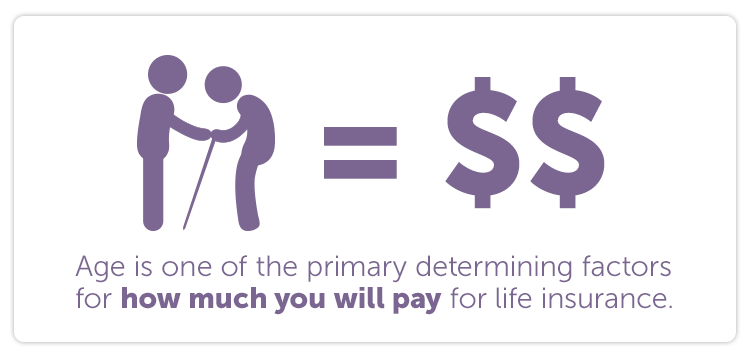

1) Apply early. Age is one of the largest determining factors for life insurance premiums. In most cases, the younger you are when you apply for life insurance, the less you’ll pay. So if you’re on the fence about applying now or later, consider applying now, even if you’re not sure how much coverage you need. You can always add a second policy later or increase your coverage if you need more protection as you age.

2) Opt for term insurance. Term insurance provides a set amount of life insurance at a fixed rate for a specific period of time, from one year to twenty years or more. The longer the term you purchase, the less the initial cost will be per year. Be aware, if you choose to renew term insurance at the end of the term, the new costs will be significantly higher.

3) Get less insurance. Depending on your situation, you may not need to replace all your income. Figure out what your death would mean financially to your family and determine their needs – both short term (paying for your funeral) and long term (paying off the mortgage, education costs, etc.). Determine if you could provide for most of your family’s needs with less life insurance. If so, your family would still have some protection, but you won’t have to pay as much each month or year.

4) Improve your health rating. Health issues will make your insurance more expensive. Getting healthier can mean savings. Quit smoking, eat healthier and exercise regularly. Lowering your cholesterol and blood pressure, and losing weight can help reduce your premiums by quite a bit.

5) Pay annually rather than monthly. Depending on the life insurance product purchased, there are often slightly higher premiums if you have decided to pay monthly rather than annually.

6) Seek the help of a financial advisor. As with other insurance products, life insurance premiums can vary dramatically from one insurer to the next. Speak to a financial advisor who is familiar with life insurance savings and can find the best policy and price for you.

It may be something we don’t want to think about but it doesn’t have to be difficult.

You make at least a hundred different decisions every day. There are quick and easy ones: What time to wake your kids up for school? Which food is least likely to be snubbed by your family? Then there are more challenging ones: Which school your child should attend? Is 12 to young for a cell phone?

Then there are difficult decisions that we struggle with, and that can lead to a catatonic state of procrastination.

Financial decisions top the list of items that people put off making decisions on1, particularly when it comes to purchasing life insurance. The truth is, it may be something we don’t want to think about but it doesn’t have to be difficult.

To make purchasing life insurance easier, here are five questions you need to ask yourself:

1) How Much?

Everyone’s financial circumstances and priorities are different but here are some questions to help you focus on what your family would need if you were to die:

- How much money will your family need to meet immediate expenses such as funeral expenses, legal fees and outstanding debts and mortgage balances?

- How much money will your family need to maintain their standard of living over perhaps several years?

A simple starting point is to look at your monthly expenses. List everything that you have to pay for – food, utilities, transportation, housing costs, extra-curricular activities for the kids, and your child’s post secondary education. Then determine how many years you want to cover these expenses.

2) Can We Afford It?

The ability to manage all of your financial obligations can seem daunting at times and adding one more bill to the growing pile is something you probably try to avoid at all costs.

You’re not alone. One of the top reasons why people delay buying life insurance is the perception that it is too expensive.

However, many life insurance options are extremely affordable. The important thing to remember is that some life insurance is better than nothing.

There are many quick life insurance on-line quote tools that can show you how much life insurance you can purchase within your monthly budget. This may mean opting for a smaller policy initially but as your financial situation changes, debts are paid off or a salary increase occurs, you can always opt to add more life insurance coverage.

3) What Type?

While all life insurance plans are designed to pay a benefit when someone dies (called a “death benefit”), there are two basic categories of life insurance: term life insurance and permanent life insurance.

Term Life Insurance

Term life insurance is designed to provide a specific death benefit if you die during a specific period of time, or “term” as the name indicates. The term may be a fixed number of years (eg. 10 or 20 years) or to a set age (eg. age 75). If you die during the term of the policy, your beneficiaries will receive the death benefit. If you don’t die during the term of the policy, no one gets the death benefit and the insurance ends.

Permanent Life Insurance

Permanent life insurance is designed to provide you with insurance protection for your entire life, no matter how long that is. This means you can keep your life insurance coverage as long as you live and pay your premiums.

In simple terms, the difference between permanent life insurance and term life insurance is like the difference between buying or renting your home. You can rent a home to meet your temporary needs and if you decide you need it longer, you can usually continue to lease it again, and again, but the rent increases each time you renew the lease – similar to term life insurance. Permanent life insurance is like buying your home. You can keep it for as long you want, provided you make the payments, with the added potential of building equity.

It is important to note that both term life insurance and permanent life insurance have many subcategories or variations that can allow you to tailor your life insurance policy based on your needs. Each type of life insurance has benefits, but the reality is most Canadians will have the need for both.

4) Where Can I Get Advice?

Discussing your life insurance needs and options with a life insurance advisor typically doesn’t cost you anything, and an advisor will provide you with valuable information that can help you purchase the life insurance you need and can comfortably afford.

Just like every other important choice that life presents to us – choosing a partner or spouse, a job, or a place to live – selecting your life insurance advisor needs careful consideration. In the end, choosing an advisor comes down to trust. You will be providing your advisor with many details regarding your financial life and you need to feel that your advisor has listened to you and given you good advice about the insurance that’s right for you based on your needs.

Don’t be afraid to reach out to a life insurance advisor to help you with customizing an insurance plan that is right for you and your family. An advisor can help you get organized and he or she can leverage their industry knowledge to take a ton of work off your plate.

Find an Advisor can help connect you with an insurance advisor. Check it out.

5) How Complicated Is It To Get Life Insurance?

The purchase of life insurance does not need to be a complicated process.

There are also easy-to-use online insurance applications that can be completed in the comfort of your own home while a life insurance advisor walks you through it either while talking with you on the telephone and using a computer screen sharing software, or by meeting with you in person, whichever you prefer.

Life insurance is a valuable tool that can be simple and easy, flexible and dependable and make sense no matter what your personal situation.

Take the initiative now, help protect your family and make the important decision to purchase life insurance.

1Source: Using Behavioural Economics to Sell, LIMRA, 2012

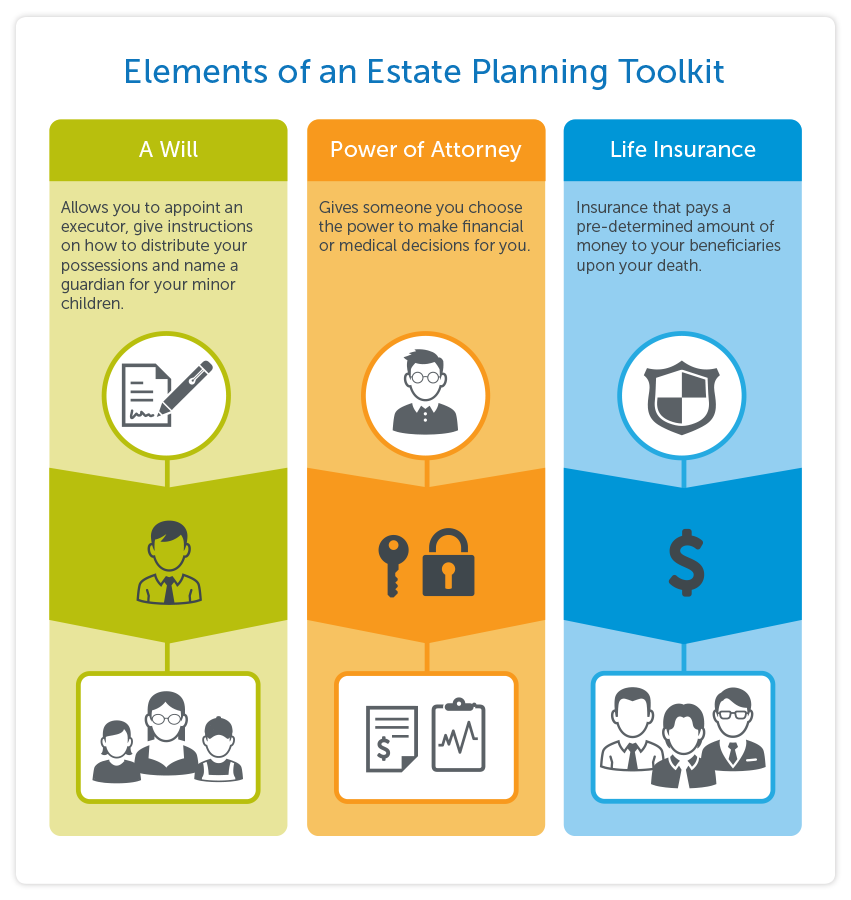

What is “estate planning”?

The word “estate” most likely drums up pictures of affluent individuals like the Bill Gates or Warren Buffets of the world, but whether you think it or not, you have an estate. Your estate is comprised of everything you own, from your car, home, bank account and investments, to your grandmothers wedding rings you inherited and your personal collection of classic movies.

No matter how large or how modest, everyone who owns property has an estate and something in common – you can’t take it with you when you die.

Estate planning simply refers to making a plan in advance so when you pass away your property will be distributed among the people or organizations you choose and in the way you think is best. It also may include strategies for minimizing taxes and legal fees.

Estate planning is important for everyone but it can mean the most to families with modest assets since they can afford to lose the least.

Source: Lawyers’ Professional Indemnity Co. (LawPRO), May 2012

Source: Lawyers’ Professional Indemnity Co. (LawPRO), May 2012

What’s the role of life insurance in estate planning?

Life insurance plays a very important role in your estate planning for a number of different needs. First off, though, it is important to define “estate planning”. Traditionally life insurance needs have fallen into two categories:

- needs around income replacement (sometimes referred to as estate creation); and

- needs around estate transfer (sometimes referred to as estate preservation).

Income replacement needs generally occur when you are younger and have family members depending on your income for ongoing support. If you were to die prematurely, life insurance can provide a source of tax-free financial resources to replace your lost income and help your family meet their ongoing needs.

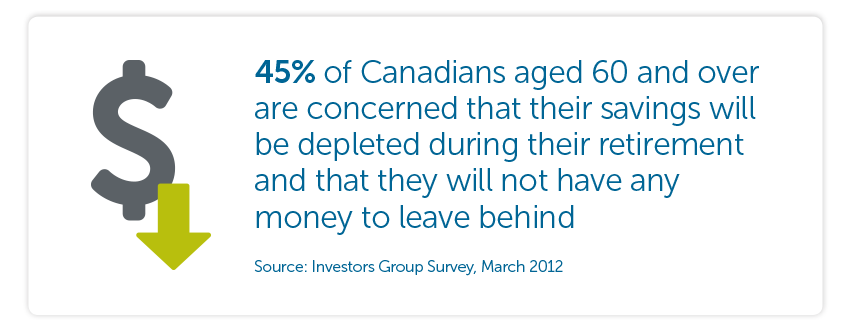

Estate transfer needs generally come later in life, once financial resources have already been accumulated. To preserve and transfer these resources, life insurance can be both economical and tax-efficient. Estate transfer needs can be somewhat broader than income replacement needs and could include:

- Covering taxes and probate fees on death

- Providing for last expenses including funeral, legal and executor costs

- Allowing children to be treated equally when a parent wants to leave a large, asset like a business, cottage or farm to one chid and an equal amount of cash to another child

- Facilitating charitable donations

- Growing financial resources in a tax-sheltered environment

Source: Investors Group Survey, March 2012

Source: Investors Group Survey, March 2012

Having identified a role for life insurance in your estate plan, you will need to consider other questions like “How much life insurance do I need?” and “What type of life insurance best meets my needs?” Talk to an insurance advisor to help you work through these questions.

Some final thoughts on estate planning

Remember that estate planning does not have to be expensive or time consuming and the best time to make an estate plan is now because if you wait, it may be too late.

If you don’t think you can afford a complex estate plan now, start with what you can afford. For a young family or single adult, that may mean a simple will, power of attorney and a life insurance policy. Your estate plan can develop and expand as your needs change and your financial situation improves. This may mean updating your will and changing you life insurance coverage in the future. It’s important to understand the options and flexibility a life insurance policy can offer before you purchase it.

Knowing you have a properly prepared estate plan in place – one that contains your instructions and protects your family – can give you and your family peace of mind. Isn’t that one of the most thoughtful and considerate things you can do for yourself and for those you love?

At some point in time, you will most likely consider whether you need life insurance.

To help decide, start by asking yourself – if you died today, would someone suffer financially because of your death?

If the answer to this question is “yes” – then you probably need life insurance.

For many individuals, the answer is yes. Even if you leave no other costs behind, at the very least, someone might have to pay for your funeral or memorial, and very few people want to leave those costs to mourning spouses, family members or friends.

(Funeral Service Association of Canada (FSAC) – October 2013)

Beyond funeral expenses, you may also leave behind debt, taxes or the cost of ongoing care of a spouse or children. If you’re married, have children, are a small-business owner, support your parents, siblings or other individuals, you probably need at least some life insurance coverage.

Some People Don’t Need Life Insurance

There are individuals that may not need life insurance. If no one depends on your income, and no one will suffer financially when you die, then life insurance might not be a necessity for you – now.

For example, if you’re single and have no children, have very little debt and have enough in savings to cover funeral costs, then you don’t necessarily have an immediate need for life insurance.

Keep in mind though that your personal circumstances can change over time. If you’re young and healthy, you may want to look into buying a life insurance policy now, regardless of the fact that you may not currently have a spouse or children relying on your income. In most cases, the younger you are when you apply for life insurance, the less you’ll pay.

(Canadian Life and Health Insurance Association, 2012)

The need for life insurance varies depending on your personal situation. Take the time to look at your circumstances, ask the tough questions, and don’t be afraid to reach out to a life insurance advisor that can help you narrow down your options.

To help connect you with an insurance advisor, check out Find an Advisor.

One of the most bewildering aspects of life insurance is there seems to be so many types available – all with their own unique, and sometimes confusing, product names depending on the insurance company offering the product.

Similar to how you can purchase anything from a Sorento to a Sonata, or an Accord to an Accent, you can also purchase life insurance products with a variety of naming conventions. With a vehicle though, your first decision is whether you want to purchase a car or a truck based on the need to be met. Similarly, there are different types of life insurance products to meet different types of needs.

While all life insurance plans are designed to pay a benefit when someone dies (called a “death benefit”), there are two basic categories of life insurance: term life insurance and permanent life insurance.

Term Life Insurance

Term life insurance is designed to provide a specific death benefit if you die during a specific period of time, or “term” as the name indicates. The term may be a fixed number of years (eg. 10 or 20 years) or to a set age (eg. age 75). If you die during the term of the policy, your beneficiaries will receive the death benefit. If you don’t die during the term of the policy, no one gets the death benefit and the insurance ends.

Typically, term life insurance is purchased when there is a temporary need that will end at a future date, such as the duration of a mortgage, for a business obligation, or when funds need to be available for a child’s post secondary education or your spouse’s retirement.

Since term life insurance is designed to provide you with life insurance coverage for only a specific length of time, the amount you pay during the initial term is typically lower than for other types of life insurance products, and the longer the term you purchase, the less the initial cost can be per year.

*Based on available rates for a healthy, 40-year-old female, non-smoker, purchasing $250,000 of Empire Life 20 year term life insurance as of June 2014.

One thing to keep in mind, though, if your term life insurance renews at the end of the term, the new costs will be significantly higher. As a result, it is important to determine your overall needs. Some term life insurance automatically renew at the end of the term for additional terms, but usually the insurance can’t continue past a certain age (often age 75 or 80).

Permanent Life Insurance

Permanent life insurance is designed to provide you with insurance protection for your entire life, no matter how long that is. This means you can keep your life insurance coverage as long as you live and pay your premiums.

Another key element of permanent insurance is that with each payment you make, a certain portion of that payment can be deemed a savings component or contribute to your policy’s “cash value.” As a result, this type of policy offers you a number of “living benefits”, including the ability to access that money if you need it (for example, to pay tuition, contribute to a down payment on a home, or to help meet your retirement needs). However, accessing this money could reduce the death benefit or terminate the insurance.

Generally, the payments for permanent life insurance are higher than for the same amount of term life insurance. This is a result of building up the cash values or savings in the policy, as well as the fact that this policy is guaranteed to last as long as you do and the premiums are paid.

Comparing the Two Types

In simple terms, the difference between permanent life insurance and term life insurance is like the difference between buying or renting your home. You can rent a home to meet your temporary needs and if you decide you need it longer, you can usually continue to lease it again, and again, but the rent increases each time you renew the lease – similar to term life insurance. Permanent life insurance is like buying your home. You can keep it for as long you want, with the added potential of building equity.

It is important to note that both term life insurance and permanent life insurance have many subcategories or variations that can allow you the opportunity to tailor your life insurance policies based on your needs.

*LIMRA, Canadian Life Insurance Ownership, Personal-Level Trends, 2013

Each type of life insurance has benefits, but the reality is most Canadians will have the need for both. Seeking further guidance and advice from a financial advisor can help develop a customized insurance plan for you and your family.

Case Study

A healthy, 40 year old female, non-smoker could cover a $250,000 mortgage (Stats Canada average mortgage amount for a new home in Canada, 2011) with a 20 year term life insurance policy from us for less than the cost of a daily cup of coffee – $25.43*/month.

* Initial monthly cost for a healthy, 40 year old female, non-smoker purchasing $250,000 of life insurance as of May 1, 2014. Price increases every 20 years.

The above information is for general information purposes only and is not intended as professional advice or as a price guarantee. CJSimon assumes no responsibility if you rely on the above information or if it contains an error.